Dan Green

Homebuyer.com

Dan Green (NMLS 227607) is a licensed mortgage professional who has helped millions of people achieve their American Dream of homeownership. Dan has developed dozens of tools, written thousands of mortgage articles, and recorded hundreds of educational videos. Read more about Dan Green.

This website discusses mortgage programs and how to qualify. Your eligibility may vary based on lender guidelines and investor overlays. Check with your lender for specific details.

Trusted Content

This article was checked for accuracy as of September 19, 2024. Learn more about our commitments to accuracy and your mortgage education in our editorial guidelines.

Updated: September 19, 2024

The Federal Reserve voted to lower the Fed Funds Rate by 50 basis points at its September 2024 FOMC Meeting. The Fed Funds Rate is now in a target range near 4.75 percent.

The Federal Reserve, often called “The Fed,” is the U.S. government’s central bank. It was established by the Federal Reserve Act of 1913.

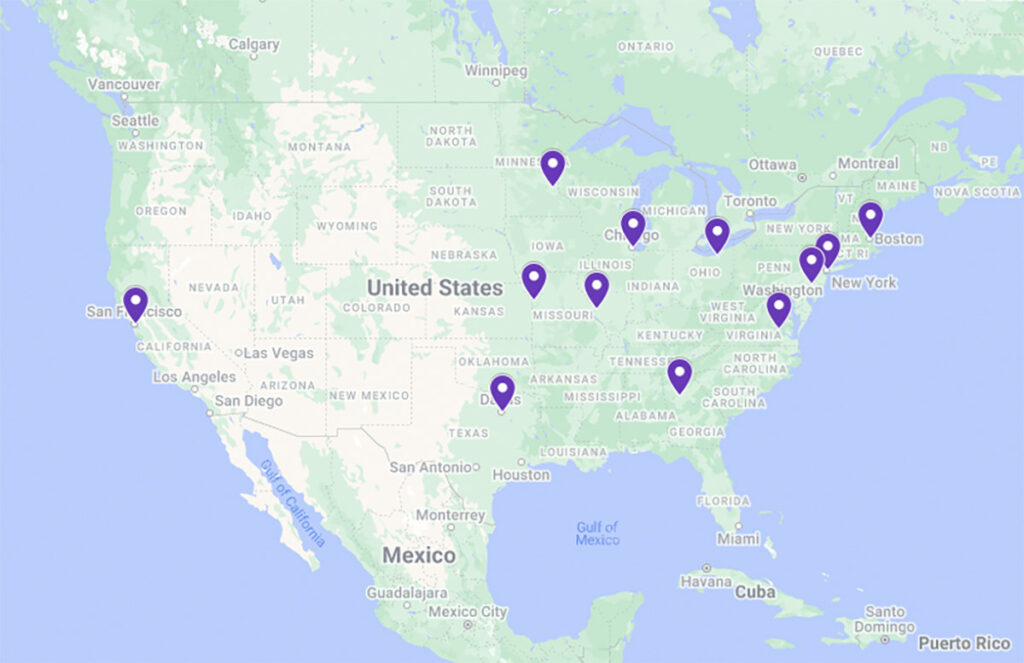

The Federal Reserve is the independent central bank of the United States. It comprises 12 regional Federal Reserve Banks and a Board of Governors based in Washington, D.C.

The Fed maintains the stability of the U.S. financial system through three primary roles:

The Federal Reserve operates independently from Congress and the White House. It is known for three major economic interventions:

The Fed also stabilized the economy during the COVID-19 crisis starting in 2020.

Check your eligibility and begin your application now.

The Fed Funds Rate is the Federal Reserve’s key tool for influencing economic growth.

This rate sets the interest for overnight loans between banks, typically to meet cash reserve requirements. It also serves as the basis for the Prime Rate, which is often used for home equity lines of credit and is generally 300 basis points higher than the Fed Funds Rate.

Raising or lowering the Fed Funds Rate affects the U.S. economy by either slowing it down or speeding it up.

When the Fed Funds Rate is low, banks have more funds to lend, encouraging consumer and business spending, job creation, and economic growth.

When the Fed Funds Rate is high, lending decreases, which slows down economic activity.

Given sufficient time, a low Fed Funds Rate can spur growth and inflation, while a high Fed Funds Rate can slow growth and result in recession.

The Federal Open Market Committee (FOMC) is a 12-member group within the Fed that makes decisions about the Fed Funds Rate and other policies like treasury bond purchases and mortgage-backed securities.

FOMC members include:

The FOMC meets eight times per year in Washington, D.C.

The upcoming FOMC calendar is as follows:

The FOMC also holds emergency meetings when needed, as it did during these key dates:

Since 2000, the Fed has made 70 changes to the Fed Funds Rate.

The FOMC’s most recent meeting was held September 17-18, 2024. The committee voted to drop the Fed Funds Rate by 0.50 percentage points to a target range near 4.75 percent.

In his post-meeting statement, Fed Chairman Jerome Powell emphasized the Fed’s commitment to stabilizing prices and mentioned that the rate would likely drop again in 2024.

The FOMC reiterated: “The Committee has gained greater confidence that inflation is moving sustainably toward 2 percent, and judges that the risks to achieving its employment and inflation goals are roughly in balance.”

The Fed highlighted strong job growth and low unemployment as positive drivers of the economy, and noted a slowdown in the sale of its government and mortgage-related securities.

The Federal Reserve sets the Fed Funds Rate, not mortgage rates.

While the Fed doesn’t directly control today’s mortgage rates, it does influence them through its monetary policy, particularly by how it manages inflation, a key factor in mortgage rate movements.

Mortgage rates and the Fed Funds Rate don’t always move in tandem.

However, both mortgage rates and Fed policies react to inflation.

If inflation is expected to rise, mortgage rates tend to rise, and when inflation is expected to fall, mortgage rates usually decrease as well.

Thus, when the Federal Reserve signals inflation is increasing, mortgage rates often rise. When it signals that inflation is falling, mortgage rates tend to drop.

In this way, what the Fed says about inflation can be more impactful on mortgage rates than its actual actions.

The next Fed meeting is a 2-day event scheduled for November 6-7, 2024, adjourning at 2:00 PM ET.

The Fed is not expected to raise the Fed Funds Rate after its November 2024 meeting. The next move is expected to be a rate decrease.

The Fed may vote to lower the Fed Funds Rate after its November 2024 meeting, but it’s unknown by how much and exactly when the next cut will occur.

The Federal Reserve makes U.S. monetary policy, influencing growth, employment, and inflation rates.

The Federal Reserve sets the Fed Funds Rate, impacting borrowing costs, consumer spending, and investment, which drive economic growth.

The minutes of FOMC meetings are available three weeks after the meeting, offering insights into the Fed’s outlook and policies. Its press releases are available immediately.

The U.S. Treasury prints physical currency, but the Federal Reserve controls the money supply, including bank reserves.

The Federal Reserve does not set mortgage rates, but its policies influence their movement.

The Federal Reserve bases rate decisions on economic data, lowering rates when it determines that economic conditions justify it.

The Federal Reserve is overseen by a Board of Governors consisting of seven members, appointed by the President and confirmed by the Senate.

This article, "What Is The Federal Reserve?," authored by Dan Green, is based on extensive professional mortgage experience and includes references to trusted sources such as industry-leading financial institutions and expert research from the following websites:

This article was last updated on September 19, 2024.

Wave goodbye to waiting times and say hello to our faster, better mortgage application. It's available anytime you are, 24/7/365. The power to approve your mortgage is just a click away.

A Division of Ixonia Bank

Member FDIC. Equal Housing Lender.

Homebuyer.com

Operated by Novus Home Mortgage,

A Division of Ixonia Bank

1311 Vine St

First Floor

Cincinnati, OH 45202

513-824-8171

Notices

Mortgages

Notifications